|

THEMATICS| Biotech in Singapore

By GROW with Singlife Contributor : Farhan Ahmad Mumtaz Key Findings

Key Findings #1

Singapore’s biotechnology sector is rapidly evolving, driven by strong government support, world-class research infrastructure, and strategic investments. With a focus on innovation, talent development, and regulatory excellence, the country continues to attract global biotech firms and investors, reinforcing its status as a leading hub for life sciences and biomanufacturing in ASEAN.

Key Findings #2

The nation’s commitment to R&D, combined with growing investor interest and SGX-listed biotech companies, provides strong growth opportunities. However, challenges remain in talent acquisition, regulatory adaptation, and scaling biotech startups for long-term success in global markets.

Overview & Trends

Singapore’s software sector is a key pillar of the digital economy, which has significantly contributed to GDP growth, expanding at a CAGR of 11.2% from 2018 to 2023, outpacing overall economic growth.

Supported by innovation-driven policies, world-class biomanufacturing facilities, and a thriving life sciences sector, Singapore excels in areas like precision medicine, biopharmaceutical R&D, and alternative proteins, bolstered by strong venture capital funding and SGX access.

Singapore's stable political environment, robust infrastructure, and pro-business policies have positioned it as a leading Asian biotechnology hub. The nation's solid economic foundations are complemented by a well-established research ecosystem and innovation-friendly regulations. According to global strategy firm LEK Consulting , as of 2022, Singapore is home to over 52 biotechnology firms, a significant increase over the previous decade. This number is projected to increase by more than 60% by 2032. These companies operate under the oversight of the Health Sciences Authority (HSA), ensuring rigorous regulatory standards.

The biotechnology ecosystem in Singapore encompasses diverse sectors, including biopharmaceuticals, medical technology, and agricultural biotech. This dynamic environment has fostered major developments, such as the establishment of specialized research institutes and industrial parks:

Singapore also serves as a strategic base for multinational pharmaceutical companies, including Pfizer, Novartis, Abbott, GlaxoSmithKline, and Lonza, all of which have established research or manufacturing centers in the country. This presence underscores Singapore's role as a gateway to the Asian market.

The country's pro-business environment, characterized by a favorable tax regime and access to domestic capital markets like the Singapore Exchange (SGX), has made it an attractive destination for venture capital and private equity funding in the biotech sector. Notable biotech companies contributing to Singapore's growing prominence include:

These companies exemplify the innovative spirit and technological advancement within Singapore's biotech industry.

However, the sector faces challenges that could impact its development and the fundamental prospects of individual companies:

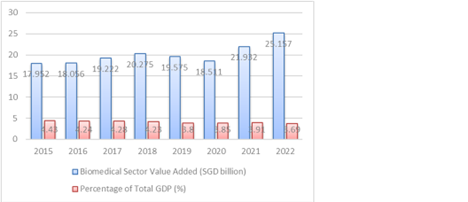

Despite these challenges, Singapore's commitment to fostering a conducive environment for biotechnology innovation continues to drive the sector's growth and solidify its status as a leading biotech hub in Asia. Chart 1: BIOMEDICAL SECTOR GROWTH TREND (SGD BILLION, 2015-2022)

Source: World Bank, SingStat(Gov)

MACROECONOMIC OVERVIEW

Singapore’s Macroeconomic Strengths Fueling Biotech GrowthA Stable and Innovation-Driven Economy

Singapore’s biotechnology sector thrives on the nation’s stable political environment, strong rule of law, and advanced infrastructure—key factors for high-tech industries. Pro-business policies have long positioned Singapore as a leading hub for technology and innovation in Asia, fostering confidence for long-term R&D investments.

Economic Fundamentals and R&D Commitment

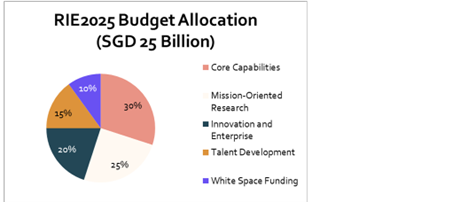

As a high-income economy with a GDP per capita exceeding US$70,000 and a AAA credit rating, Singapore provides biotech firms with a reliable operating environment. The government views R&D as a strategic economic driver, allocating approximately 1% of GDP to public R&D annually—among the highest global rates. The Research, Innovation, and Enterprise 2025 (RIE2025) plan earmarks S$25 billion (≈US$18 billion) for science and technology research from 2021 to 2025, demonstrating a steadfast commitment to innovation. Even during the COVID-19 pandemic, Singapore sustained R&D investments, leading to one of the world’s lowest mortality rates and reinforcing the long-term benefits of consistent research funding.

Biomedical Industry as an Economic Pillar

Biotechnology and biomedical industries have become key contributors to Singapore’s economy. Singapore's biotechnology and biomedical industries became key economic contributors following the government's designation of biomedical sciences as the economy's "fourth pillar" in 2000, alongside electronics, chemicals, and engineering. By the mid-2000s, Singapore had rapidly established itself as a global biopharmaceutical manufacturing hub, attracting over 60 biomedical production facilities from multinationals like Pfizer, Novartis, Merck, and Roche. However, by the mid-2010s, initial enthusiasm had outpaced tangible commercial outcomes, prompting a strategic shift toward translational research, commercialization, and medical technology from the late 2010s onward, aiming for more sustainable growth and innovation.

According to Economic Development Board, In 2022, Singapore’s biomedical manufacturing output exceeded S$14 billion, with the broader biomedical sector (including medtech) generating S$39 billion in global market output, contributing roughly 2.3% to GDP. The pharmaceutical industry alone added an estimated S$9–10 billion in value-add to GDP. The biomedical workforce has expanded significantly, with over 9,000 professionals—a 70% increase in a decade—engaged in specialized roles such as bioprocess engineering and research.

Biomanufacturing and Global Competitiveness

Singapore’s robust biomedical manufacturing base anchors its biotech sector. By 2022, the nation housed over 60 biomedical production facilities, including seven of the world’s top 10 pharmaceutical firms. Singapore’s strategic location in Asia, coupled with strong intellectual property (IP) protection, enhances its appeal as a regional base for biotech manufacturing and R&D. Recent large-scale investments—such as Pfizer’s US$1 billion API plant and AstraZeneca’s planned US$1.5 billion facility—signal continued global confidence in Singapore’s role as a biopharma production hub.

Beyond manufacturing, Singapore’s connectivity and openness to trade make it a prime location for biotech distribution and clinical development. Many pharmaceutical firms establish their Asia-Pacific headquarters and logistics centers in Singapore. As a global financial center, Singapore also facilitates biotech funding through venture capital, private equity, and public markets on the Singapore Exchange (SGX).

Human Capital and Research Infrastructure

Singapore’s highly educated workforce is a key asset for biotech growth. With a strong emphasis on STEM education, the country has nearly 40,000 researchers, scientists, and engineers—an impressive figure for a nation of 5.6 million people. Major universities like the National University of Singapore and Nanyang Technological University, along with polytechnics, produce a steady stream of bioscience graduates. The government encourages Singaporeans to pursue biomedical PhDs and postdoctoral research, while the country’s high quality of life attracts top international researchers. While Singapore offers a deep talent pool, certain niche skills—such as experienced biotech entrepreneurs and regulatory experts—are still developing.

Complementing human capital is a world-class research ecosystem. The Biopolis research park, established in 2003, provides cutting-edge labs and fosters collaboration between public research institutes and corporate R&D centers. Research organizations under the Agency for Science, Technology and Research (A*STAR) drive innovation in genomics, bioinformatics, and molecular biology. This infrastructure, combined with strong IP protection and a clear legal framework, strengthens Singapore’s position as a biotech R&D hub. As one investor noted, “Singapore’s strategic location and robust IP framework make it an ideal base for biomedical companies targeting regional markets.”

Market Access and Regional Integration

Despite its small domestic market, Singapore’s biotech sector benefits from extensive trade links and regional connectivity. Positioned as a gateway to the Asia-Pacific healthcare market, Singapore enables firms to access ASEAN’s 660 million consumers for clinical trials, sales, and expansion. International research collaborations with institutions in the US, Europe, and China further enhance Singapore’s biotech ecosystem. The country’s high regulatory standards also help biotech innovations gain broader market acceptance.

Summary

Singapore’s macroeconomic landscape—marked by stability, innovation-centric policies, and strong government backing—provides biotech firms with the confidence to invest for the long term. Its advanced infrastructure, skilled workforce, and strategic location enable companies to develop, manufacture, and distribute cutting-edge biotech solutions. The alignment of Singapore’s economic strategy with biotech development has been instrumental in transforming the nation into a leading global biotechnology hub.

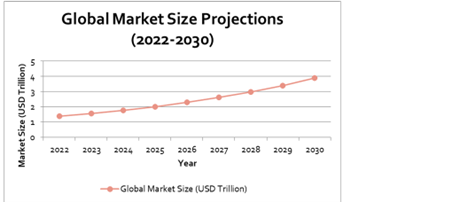

Chart 2: Global Biotech market size projections

Source: Grandview Research KEY REGULATORY DEVELOPMENTS IN THE SINGAPORE SOFTWARE SECTOR

Singapore’s government has played a pivotal role in fostering the growth of its biotechnology sector through proactive policies and regulatory frameworks. A balanced approach—encouraging innovation while ensuring quality and safety—has been key to developing a thriving biotech ecosystem. National strategies, funding commitments, and a supportive regulatory environment have collectively positioned Singapore as a leading biotech hub in Asia.

National Biomedical Strategies

A significant milestone in Singapore’s biotech journey was the National Biomedical Sciences Initiative launched in 2000. This strategic move formally recognized biomedical research as a key economic pillar, unlocking substantial government funding and leading to the creation of new institutions. A flagship project was Biopolis, established in 2003 in Singapore’s one-north district. Biopolis co-locates public research institutes (under A*STAR) with corporate labs and startups, fostering collaboration and signaling to the global biotech community that Singapore was serious about life sciences.

Over the next 15 years (2000–2015), the government invested over US$2 billion to build the biomedical research industry from the ground up. The commitment continued under successive five-year Research, Innovation, and Enterprise (RIE) plans. Under RIE2020 (2016–2020), Singapore allocated S$4 billion to Health & Biomedical Sciences research. In the current RIE2025 plan, one of four strategic domains is “Human Health and Potential”, ensuring a significant portion of the S$25 billion budget is directed towards biomedical innovation. Key focus areas include translational clinical research, precision medicine, and tackling national health challenges like aging and chronic diseases.

The government’s phased approach reflects an evolution from building basic research infrastructure to strengthening industry linkages. The latest phase (2021–2025) emphasizes precision medicine, preventive care, and longevity research, aligning with Singapore’s broader healthcare priorities.

Chart 3: SINGAPORE RESEARCH, INNOVATION, AND ENTERPRISE(RIE) BUDGET ALLOCATION

Source: Parliament of Singapore

R&D Incentives and Institutions

Singapore offers substantial R&D tax deductions (up to 250% on qualifying R&D expenses), benefitting biotech firms with high research expenditures. Grants through Enterprise Singapore and National Research Foundation (NRF) support biotech startups and proof-of-concept studies. Notably, the Early Stage Venture Fund and Startup SG programs provide co-investment funding for early-stage biotech startups.

A*STAR (Agency for Science, Technology and Research) plays a central role in the ecosystem, operating research institutes specializing in genomics, bioengineering, molecular biology, and bioinformatics. ASTAR’s commercialization arm, Accelerate, helps spin off technologies into startups and licenses intellectual property to companies. Many biotech entrepreneurs emerge from ASTAR labs or local universities, supported by programs like the ASTAR Entrepreneurial Fellowship.

To foster deep-tech startups, SGInnovate, a government-owned entity, provides funding, mentoring, and networking platforms. Additionally, biotech-friendly immigration policies—such as the Global Investor Programme—offer permanent residency incentives to biotech entrepreneurs and scientists. Workforce development initiatives, including biotech conversion programs and fellowships, further strengthen the local talent pipeline.

Regulatory Agencies and Frameworks

Singapore’s biotech sector spans multiple regulatory domains, overseen by efficient and internationally recognized agencies:

Capital Markets and Funding Regulations

Recognizing that biotech firms require significant capital investment, Singapore’s SGX (Singapore Exchange) introduced a Life Sciences listing framework in 2009, exempting biotech companies from the standard profitability and revenue track record requirements. This enables pre-revenue biotech firms to list on SGX Mainboard, provided they meet minimum market cap and disclosure requirements.

In 2021, Singapore launched a SPAC (Special Purpose Acquisition Company) framework, allowing high-growth biotech firms to access public markets via mergers. Several SPACs backed by Temasek’s Vertex Ventures have actively scouted biotech targets, enhancing funding opportunities for the sector.

Intellectual Property and Legal Environment

Singapore ranks among Asia’s top countries for IP protection, making it an attractive destination for biotech R&D. The country’s patent laws align with international standards, offering data exclusivity for pharmaceutical test data. Singapore is also a signatory to the Patent Cooperation Treaty (PCT) and Budapest Treaty, facilitating biotech patents and microorganism deposits. This robust IP regime and strong contract enforcement make Singapore an ideal base for biotech firms seeking to protect their innovations.

Environmental, Social, and Governance (ESG) and Biosafety

Singapore ensures biotech developments align with ethical and environmental considerations:

Summary

Singapore’s biotech-friendly regulatory landscape, long-term government commitment, and robust infrastructure have established it as a major player in the global biotech industry. National strategies provide funding and direction, institutions cultivate R&D and startups, while pragmatic regulations facilitate commercialization. The government continually adapts policies in consultation with industry leaders, ensuring the ecosystem remains competitive. Singapore’s biotech sector is poised for continued growth, underpinned by a well-calibrated balance of innovation, investment, and regulation. SUB-THEMES: TRENDS AND DRIVERS

BIOTECH SUB-THEMES: TRENDS AND DRIVERS

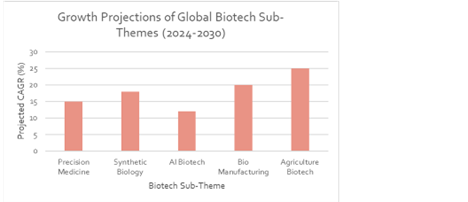

Singapore’s biotech sector is diverse and evolving rapidly, driven by strategic initiatives and investments. This report highlights three key sub-themes shaping the industry: (1) Biopharmaceuticals & Precision Medicine, (2) Agritech & Alternative Proteins, and (3) Industrial & Environmental Biotechnology. Each area presents unique growth opportunities, underpinned by government support and market dynamics.

Biopharmaceuticals & Precision Medicine Biopharma R&D and Therapeutics Pipeline

Singapore’s biopharmaceutical sector has grown significantly since the early 2000s, now hosting over 140 biotech enterprises focused on drug discovery, diagnostics, and delivery. Many startups originate from A*STAR and local universities, while global players like Amgen and Takeda have established research hubs. Oncology, metabolic diseases, cardiovascular conditions, neurological disorders, and infectious diseases are priority areas guiding national healthcare funding.

Cell and gene therapies are a major focus, with companies like Tessa Therapeutics pioneering CAR-T treatments. While some trials have faced setbacks, firms like Hummingbird Bioscience continue to attract international investment. Singapore’s venture mindset is maturing, fostering risk-taking and deeper collaborations with multinational pharmaceutical firms. Programs such as Amgen’s “Golden Ticket” initiative at Biopolis further support biotech startups.

National Precision Medicine Program

Launched in 2017, Singapore’s National Precision Medicine (NPM) program aims to integrate genomic and clinical data to enhance healthcare outcomes. The initiative’s first phase (SG100K) sequenced 100,000 genomes across different ethnicities, creating one of Asia’s most comprehensive genomic databases. By 2027, the program aims to expand to one million genomes, supporting advancements in pharmacogenomics, targeted therapies, and AI-driven diagnostics.

Singapore’s ecosystem attracts global genomics firms like Illumina and PacBio, which collaborate on sequencing technologies. The country’s robust data infrastructure—including National Electronic Health Records—positions it as a regional leader in precision medicine, creating opportunities for biotech firms in AI-driven drug discovery and personalized treatments.

Biologics Manufacturing and Innovation

Singapore is a premier location for biologics manufacturing, with pharmaceutical giants such as Lonza, Roche, Novartis, and GSK operating large-scale production facilities. Investments like Pfizer’s S$1 billion expansion reinforce Singapore’s expertise in biologics and process engineering. Additionally, cell therapy and gene vector manufacturing facilities, such as A*STAR’s Cell Therapy Facility (CTF), provide essential resources for clinical trials.

Biopharma trends include increased AI integration in R&D, with firms like Biofourmis leveraging digital health solutions. Additionally, late-stage clinical development is gaining traction, with TauRx Pharmaceuticals advancing an Alzheimer’s drug to Phase III trials. While Singapore’s small population limits domestic trials, its strategic position as a launch market for novel therapies enhances its biotech standing.

Agritech & Alternative Proteins Urban Agritech and Alternative Proteins

Singapore’s “30 by 30” goal—producing 30% of nutritional needs locally by 2030—has spurred innovation in urban farming and alternative proteins. Advanced vertical farms like Sky Greens and aquaculture hubs leverage biotechnology to enhance yields. Research into plant biotechnology is optimizing crop growth for controlled environments.

Alternative proteins are a key frontier, with Singapore becoming a global leader in cultivated meat and fermentation-derived proteins. In 2020, it became the first country to approve a cultured meat product, GOOD Meat’s chicken bites. Since then, startups like Shiok Meats (cultivated seafood) and TurtleTree Labs (fermentation-based dairy proteins) have expanded operations, supported by government grants and regulatory clarity.

Regulatory Leadership and Market Adoption

The Singapore Food Agency (SFA) has established a clear regulatory framework for novel foods, attracting alternative protein firms. Startups benefit from initiatives like the Food Tech Innovation Centre and partnerships with A*STAR’s Singapore Institute of Food and Biotechnology Innovation (SIFBI). Global firms such as Impossible Foods and Beyond Meat have chosen Singapore as their Asian launchpad, reflecting the city-state’s strong consumer acceptance of alternative proteins.

Government support extends to public procurement strategies, potentially integrating sustainable proteins into military and hospital meals. While the alternative protein industry has seen some consolidation globally, Singapore’s early-mover advantage ensures continued leadership in this space.

Sustainability and Economic Potential

Alternative proteins align with Singapore’s sustainability goals, reducing reliance on imported meat and mitigating the environmental impact of traditional livestock farming. The government actively fosters partnerships between startups and regional food conglomerates, facilitating market expansion. As cost reductions make cultivated and plant-based proteins more competitive, Singapore’s strategic positioning as a food-tech hub will yield significant economic dividends.

Industrial & Environmental Biotechnology Synthetic Biology and Biomanufacturing

Industrial biotechnology is emerging as a key sector, leveraging biological processes for sustainable manufacturing. Synthetic biology (synbio) enables the engineering of microbes to produce chemicals, fuels, and materials. Singapore’s National Research Foundation launched a Synthetic Biology Roadmap, and NUS recently announced a S$120 million synbio initiative. Research centers like A*STAR’s Biotransformation Innovation Platform focus on bioengineering microbes for industrial applications.

A major milestone is the S$44.8 million Sustainable Biomanufacturing Technology Platform, a collaboration between A*STAR and MojiaBio. This initiative aims to produce bio-based chemicals like 1,3-propanediol (PDO), used in biodegradable plastics and cosmetics, via fermentation instead of petroleum. Singapore’s expertise in process engineering and automation positions it as a leader in sustainable biomanufacturing.

Biofuels, Waste Conversion, and Environmental Biotech

Singapore is actively exploring biofuels and waste-to-value initiatives. Research on algae-derived biodiesel and microbial fuel cells aligns with the country’s decarbonization strategy. The Maritime and Port Authority has supported biofuel trials for shipping, while startups are developing innovative waste-conversion solutions.

Food waste bioconversion is gaining traction, with firms using black soldier fly larvae to transform organic waste into animal feed and fertilizers. Additionally, research into microbial and enzymatic plastic degradation supports Singapore’s zero-waste ambitions. Water treatment technologies also benefit from biotech advancements, including membrane bioreactors and bioremediation methods for reservoirs.

Carbon Capture and Biotech in Manufacturing

Singapore is exploring bioengineered solutions for carbon capture and utilization. Research on genetically modified microbes that convert CO2 into useful chemicals presents long-term potential. Industrial biotech is also integrating into traditional manufacturing—biobased production methods may complement petrochemical operations on Jurong Island.

Companies such as GSK are collaborating with local researchers to develop greener pharmaceutical manufacturing processes, utilizing enzymatic reactions to reduce chemical waste. Consumer goods firms are also investing in biotech-based production for fragrances and food additives, reinforcing Singapore’s role in sustainable industry innovation.

Summary Singapore’s biotech sector is evolving into a critical driver of economic growth and innovation. The country’s leadership in biopharmaceuticals, agritech, and industrial biotech stems from its robust R&D ecosystem, strong government support, and strategic regulatory frameworks.

Biopharmaceuticals and precision medicine continue to attract global investment, positioning Singapore as a key player in Asia’s life sciences industry. Agritech and alternative proteins leverage technological innovation to enhance food security and sustainability, reinforcing Singapore’s reputation as a hub for novel food solutions. Industrial biotech, still in its nascent stages, promises transformative impacts in sustainable manufacturing and environmental solutions.

By integrating biotech advancements across healthcare, food production, and industrial processes, Singapore is cementing itself as a global leader in the bioeconomy. With continued investment, partnerships, and talent development, the nation is well-placed to shape the future of biotechnology, ensuring long-term economic and societal benefits.

Chart 4:Growth Projections of Biotech Sub-Themes

Source: Grandview Research

Stocks listed on Singapore Stock Exchange that offer exposure to Biotech Theme

SGX: 42C IX BIOPHARMA LTD

iX Biopharma is a specialty pharmaceutical company known for its WaferiX sublingual drug delivery technology, enabling rapid absorption under the tongue. Its pipeline includes sublingual ketamine (for depression and pain) and sildenafil (for ED). A key milestone was the out-licensing of Wafermine (ketamine) to Seelos Therapeutics, generating S$13.2M in licensing income, leading to its first net profit in 1H 2022.

SGX: 8YY BIOLIDICS LIMITED

Biolidics, a Singapore-based medtech firm, specializes in cancer diagnostics with its ClearCell system, which isolates circulating tumor cells for research and liquid biopsies. Listed on SGX Catalist in 2018, it pivoted to COVID-19 test kits in 2020, boosting revenue. Post-pandemic, it refocused on oncology and new diagnostics but faces losses and restructuring. Future growth depends on clinical adoption, partnerships, and the expanding cancer diagnostics market.

SGX:1J5 HYPHENS PHARMA INTERNATIONAL LIMITED

Hyphens Pharma, a leading specialty pharmaceutical firm in Singapore, commercializes dermatology and pediatric drugs while developing its own consumer healthcare brands like Ceradan and Ocean Health. Listed on SGX in 2018, it reported a 26.5% profit rise in FY2024 (S$10.9M) and pays dividends, making it a defensive healthcare play. Its e-pharmacy platform WellAway enhances digital distribution, while R&D in dermatology and supplements supports long-term growth in ASEAN’s healthcare market.

SGX:P8A CORDLIFE GROUP LTD

Cordlife, listed on SGX Mainboard since 2012, is a leading cord blood banking provider across Asia, offering stem cell storage for future medical therapies. Operating labs in Singapore, Hong Kong, Indonesia, India, and more, it combines biotech elements with a consumer-driven model. While cash-generative, growth depends on birth rates and market penetration. Expansion into NIPT and precision screening diversifies revenue, positioning Cordlife in regenerative medicine trends.

SGX:P27 PRESTIGE BIOPHARMA LIMITED

Prestige BioPharma Limited, established in 2015 and headquartered in Singapore, is a biopharmaceutical company specializing in the development of biosimilars, novel antibody therapeutics, and vaccines, with a primary focus on oncology and immunology. Their lead product, Tuznue® (HD201), a trastuzumab biosimilar targeting HER2-positive breast and gastric cancers, received a positive opinion from the European Medicines Agency's Committee for Medicinal Products for Human Use (CHMP) in July 2024, marking a significant milestone towards European Union commercialization. The company's pipeline also includes HD204, a bevacizumab biosimilar in Phase III trials for various cancers, and PBP1502, an adalimumab biosimilar in Phase I development for autoimmune diseases.

Additionally, PBP1510 (Ulenistamab), a first-in-class antibody targeting pancreatic adenocarcinoma upregulated factor (PAUF) implicated in pancreatic cancer progression, has been granted Orphan Drug Designation by the U.S. FDA, the European Medicines Agency, and the Korean Ministry of Food and Drug Safety, with ongoing global Phase I/IIa clinical trials. Operating globally with R&D centers in Singapore and manufacturing facilities in South Korea, Prestige BioPharma collaborates with various pharmaceutical partners to expand its market presence across Europe, North America, and Asia.

Fund Feature The following funds provide exposure to Fintech theme and can be found on the dollarDEX Fund Center

FIDELITY FUNDS - SUSTAINABLE GLOBAL HEALTH CARE FUND

The fund aims to achieve long-term capital growth by investing globally in companies engaged in healthcare, emphasizing sustainability and ESG criteria. Fidelity integrates bottom-up stock selection with thematic analysis, targeting innovative firms positioned to benefit from demographic shifts, technological advancements, and rising healthcare expenditures globally. Key holdings include leading biotech and pharmaceutical firms with robust pipelines, sustainable operations, and strong corporate governance practices

GS GLOBAL FUTURE HEALTH CARE EQUITY PORTFOLIO

This fund targets long-term growth through investments in global healthcare companies focusing on breakthrough medical technologies and therapies poised to address future healthcare needs. The portfolio emphasizes innovative firms driving advancements in areas such as genomics, precision medicine, and medical technology. Its largest holdings typically include companies at the forefront of healthcare innovation and biotechnology, providing exposure to the transformative trends reshaping the healthcare landscape.

JPM GLOBAL HEALTHCARE FUND

The JP Morgan Global Healthcare Fund seeks capital appreciation through global investment in companies across the healthcare spectrum, from pharmaceuticals and biotechnology to medical technology and healthcare services. The fund employs a rigorous bottom-up selection process to identify firms with robust fundamentals, compelling growth prospects, and innovative healthcare solutions. Top holdings typically feature prominent global healthcare leaders and biotech innovators consistently delivering superior returns.

JANUS HENDERSON BIOTECHNOLOGY FUND

This fund specializes in biotechnology, investing primarily in companies that utilize groundbreaking scientific research to develop novel therapies and medical innovations. With a highly focused approach, the fund targets biotech companies with strong intellectual property, innovative drug pipelines, and potential catalysts for significant value creation. The fund is designed for investors seeking high growth potential and exposure to advancements in biotechnology that address critical healthcare challenges.

DISCLAIMERS & CONFIDENTIALITY NOTICE IMPORTANT DISCLAIMERS This document is prepared by Navigator Investment Services Limited (UEN No.: 200103470W) ("Navigator") and is distributed for information only. It is not and does not constitute an offer, recommendation, or solicitation to enter into any transaction, to buy or sell any investment product, or to adopt any investment strategy in relation to any investment product. This document does not take into account the specific investment objectives, investment strategies, financial situation and needs of any particular person (including the intended recipient). You should not rely on any contents of this document as financial advice or recommendation to invest. Past performance is not indicative of future performance and no representation or warranty is made regarding future performance. All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness or any verification on such information and opinions has been performed. All information and opinions herein are current as at the date of this document, and subject to change without notice. To the extent permitted by law, Navigator specifically disclaims all warranties (express or implied) regarding the accuracy, completeness, or usefulness of this document and the information within and Navigator assumes no liability with respect to the consequences of relying on this document and the information within for any purpose. Navigator accepts no liability for any loss or damage arising directly or indirectly (including special, incidental or consequential loss or damage) from the use of this document. All investments are subject to risks including market fluctuation, risk, and possible loss of principal. Some investments may not be offered to citizens of certain countries such as United States. This document has not been reviewed by the Monetary Authority of Singapore (MAS). In line with MAS Fair Dealing Outcomes, we at Navigator are committed to Treating Customers Fairly CONFIDENTIALITY NOTICE This document is confidential and may contain information that is privileged. The sending of this document to any person other than the intended recipient is not a waiver of the privilege or confidentiality that attaches to it. If you are not the intended recipient, please destroy all copies of this document and do not copy, distribute or disclose this document or its contents and notify the sender immediately.

|

This website is meant for viewing only. To place order please go to www.dollardex.com